what are back taxes owed

You can owe back taxes at the federal state or local level and you can owe them. Back taxes are taxes that werent paid at the time they were due typically from a prior year.

Notice Of Levy For Back Taxes Owed By Jack Ruby 2 The Portal To Texas History

Your first step is to file back tax returns if you owe back taxes.

. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. February 7 2022. It may be necessary to contact the IRS to obtain tax records dating back a few years in order to find out what is owing.

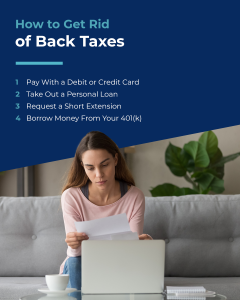

Here are four common options that could help you find some tax relief plus guidance on how to file back taxes and how many years you can file back taxes for. Back taxes are the money you owe to the Internal Revenue Service that was wholly or partially unpaid the year they were due. If you cant pay the full amount due at the time of filing consider one of the payments.

IRS tax debt is any amount of unpaid taxes owed to the government Back Taxes Owed To IRS after a tax return has been filed. Starting in 2002 it became legal for the IRS to garnish 15 of Disability benefits of those who are disabled and owe back taxes as well as Federal Old-Age and Survivor benefits. You can call the IRS at 1-800-829-1040 to determine how much you owe.

The maximum for this penalty is 25 of the total tax amount owed. Bank a business law professor at the University of California-Los Angeles who specializes in business taxation tax. As long as your taxes are overdue interest and penalties can add up fast.

This type of tax debt regularly accrues penalties and fines and. April 18 2019. Owing back taxes is very common according to Steven A.

How To Pay Back Taxes. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. Here are just a few of the issues that can arise if your business owes back taxes.

Before seizing Social Security checks the IRS first informs. The tax return can be filed late with a timely filed extension. If an individual has tax debt the IRS can seize their Social Security benefits to satisfy the debt.

Heres a summary of some of the potential taxes that. A majority 55 owe more than 10000 in taxes with 28 owing between 10000 and. Interest and penalties accrue.

Its best for all taxpayers to file and pay their federal taxes on time. Fortunately the IRS is likely to accept a payment plan for smaller amounts of back taxes. Installment Agreements are the most common way to pay back taxes to the IRS.

If this happens the IRS will send you a notice of the Failure to Pay Penalty. If the tax return is. IRS telephone assistance is available from 7 am.

Locate the IRS forms for the years you didnt file returns because tax laws and forms. Call the IRS to Determine How Much You Owe. This penalty is 5 per month that is calculated based on the total tax amount owed.

The penalty youll need to pay is usually a percentage of the taxes you failed to pay back. You can use an IA to pay back one or more years of back taxes in a single payment plan.

![]()

Back Taxes Owed Jld Tax Accounting

What Is Tax Debt Unpaid Back Taxes Can Cost You Debt Com

If You Owe Back Taxes Try Making The I R S An Offer The New York Times

Back Taxes Owed Cpa Accountant Atlanta

Solve Irs Tax Debt My Tax Hero

Back Taxes Owed Fox Tax Solutions

Be Wary Of Federal Tax Lien Settlement Offers Linked To Coronavirus Refunds Wsyx

.jpg)

Back Taxes Owed Lakewood Co Accounting Firm

What Are Back Taxes And How Do I Get Rid Of Them Bc Tax

Back Taxes Owed On Foreclosed Property Might Fall On Buyer Thinkglink

Notice Of Levy For Back Taxes Owed By Jack Ruby 1 The Portal To Texas History

Tax Services Of Hawaii Back Taxes Owed

Can The Irs Take Your House Community Tax

Finding Out How Much You Owe The Irs For Unpaid Taxes Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

Back Taxes Owed To Irs How To Get Rid Of Back Taxes

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt